Do You Own an old Apartment building?

Soft-Story Property Owners:

Protect your tenants While paying less in taxes

What is a Soft-Story building?

Soft-story buildings were popular in the 1970s and 1980s because they were considered a cost-effective way to provide more living space in urban areas.

The large openings on the ground floor were often used for parking or commercial space and were intended to increase the building's usability and appeal.

The building codes and seismic design standards were not as strict as today.

Example of a soft story collapse in San Francisco.

At that time, the focus was on providing more living space and not building resilience to seismic activity. So, many developers and architects took advantage of the less restrictive building codes to create more cost-effective buildings by adding large openings to the ground floor, resulting in these soft-story buildings' creation. However, as time passed, the vulnerability of these buildings during seismic activity became more apparent, and building codes have been updated to reflect this.

Why is this important?

It is important to deal with soft-story buildings because they are at high risk of collapse during an earthquake. The large openings on the ground floor, such as garage doors or wide windows, weaken the structural integrity of the building and make it more susceptible to collapse.

How does this affect you?

This puts the lives of anyone inside the building at risk and the building owner at fault.

The County of Los Angeles has set a deadline for retrofitting these buildings, and failure to comply can result in...

- Significant Fines

- Large Penalties

- Expensive Legal action

- Life-Threatening Scenarios

The fines for non-compliance can be substantial and will increase over time. If you ignore the retrofit requirements, the City may take legal action to force you to comply, putting your building and your business at risk.

The potential consequences of not retrofitting your building could be devastating, not only to the property but also to human life. It is important to protect yourself, your tenants, and the community.

The potential consequences of not retrofitting your building could be devastating, not only to the property but also to human life. It is important to protect yourself, your tenants, and the community.

Why're you reading this?

We offer solutions for soft-story building owners that include...

No retrofitting.

Receiving a steady income (potentially more).

Pay less in taxes.

Pass on more money to your family.

NO dealing with pesky real estate agents.

Protecting your wallet and lives.

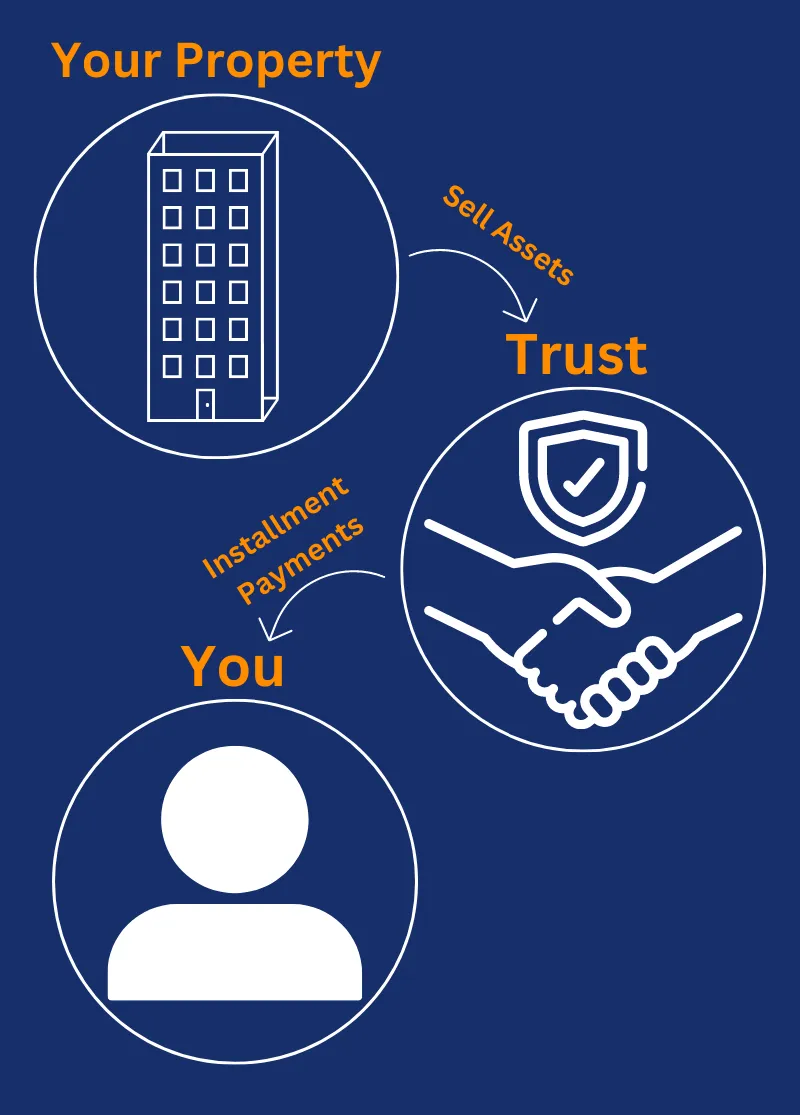

We use an Installment Sale Trust

An Installment Sale Trust is a LEGAL way to get capital gains tax relief by selling your Business or Property through a specialty trust.

First, let's talk about capital gains

Capital gains taxes are taxes imposed on the profit from selling an asset, such as a piece of real estate. The capital gain is calculated as the difference between the sale price of the property and the original purchase price, also known as the "cost basis."

For example,

if you purchase a house for $200,000 and then sell it for $1,000,000, the capital gain would be $800,000 ($1,000,000 - $200,000). In this case, you would be required to pay capital gains taxes on the $800,000 profit, which would be $288,000 in California (federal + state ~ 36%).

The capital gains tax rate can vary depending on several factors, including the time the property was held, the taxpayer's income, and whether the property was used as a primary residence. If the property was held for more than one year and was not a primary residence, the long-term capital gains tax rate could be as much as 36% with state and federal taxes combined.

Diagram of the provided example

**288k in capital gains taxes is calculated in California from a 36% capital gains (Federal + State) tax on the 800k profit.

**All numbers above are estimates; your individual circumstances may be different

**Please note that other tax considerations, such as state and local taxes and depreciation recapture, may also apply to the sale of real estate.

Why do we use an Installment Sales Trust?

An installment sales trust is a type of trust that is used to sell real estate on an installment basis. The seller sells the property to the trust, and the trust then sells the property to the buyer for cash on an installment plan. The buyer makes payments to the trust, using the money to pay the seller. The trust may also hold the title to the property until all of the payments have been made by the buyer.

This trust can help a seller obtain a larger payout and higher asset appreciation over time. It can also help a buyer obtain financing for a property they may not have been able to purchase outright.

An installment sales trust can be a complicated process, and our services can help simplify it. The trust involves several legal and tax factors that must be considered, making it difficult for an individual to navigate these complexities independently.

For example, the trust must be set up and managed correctly to provide the desired tax benefits. This requires understanding the tax laws and regulations that apply.

It is important to note that installment sales trusts are complex financial instruments, and it is advisable to consult with a tax professional or attorney to determine if it is the right strategy for your situation.

We walk you through this process

Don't navigate the complexities of an installment sales trust alone; trust our team to guide you through the process. Please reach out to us today to schedule a consultation.

Why work with us?

We've helped hundreds sell their businesses and rental properties over my 19 years of working with Installment Sales Trusts and 30+ years in business consulting.

We can help ensure that the trust is set up and managed correctly, guiding the tax implications and trust structure to maximize the benefits for the grantor.

We take our clients' assets VERY seriously. Our primary focus is to ensure that the trust is set up and managed correctly to provide the desired tax benefits while preserving the asset's value.

Schedule your Free Retrofit Consultation

Here's what others say about my services

"Kevin is a very astute expert on financial planning and investments. He prepares his recommendations clearly and with great precision."

- Edward Carels, Ph.D. Acting CEO at Addiction Recovery Resources

"Kevin did a great job for me. He's a highly skilled professional. He worked diligently with me to get me on the right path.”

- William "Bill" Craddick, Plant Manager

"Kevin is a pleasure to work with. My experience has found him to be highly conscientious and thorough with excellent follow-up skills. I

recommend Kevin for any business relationship that you may be pursuing.”

- Bruce Nelson

The Benefits of Utilizing an IST

Pay no capital gains tax at sale

Create a steady income

Leave your family with more

"Retirement is about income, not assets because not all assets return the same income."

-Kevin Brunner, Featured advisor Forbes Magazine 2015

You're only one step away

From More Time & Fewer Taxes

We have something for you!

Don't Forget Your FREE Installment Sales Trust Guide!

Nothing on this site should be interpreted to state or imply that past results are an indication of future performance. This site does not constitute a complete description of our investment services and is for informational purposes only. It is in no way a solicitation or an offer to sell insurance, annuities, securities, or investment advisory services except, where applicable, in states where we are registered or where an exemption or exclusion from such registration or licensing exists. Information throughout this internet site, whether stock quotes, charts, articles, or any other statements regarding market or other financial information, is obtained from sources that we and our suppliers believe are reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Neither our information providers nor we shall be liable for any errors or inaccuracies, regardless of cause, the lack of timeliness of, or for any delay or interruption in the transmission thereof to the user. All investments involve risk, including foreign currency exchange rates, political risks, different methods of accounting and financial reporting, and foreign taxes.